30+ what to ask a mortgage lender

Web These questions to ask mortgage lenders before buying ensures youre getting a great deal. Using this system buying one point costs 1 of your mortgage amount or 1000 for every 100000.

Investor Loan Nourihan Iskander Mortgage Loan Originator

Whats the Best Interest Rate You Can Offer Me.

. Web What questions are mortgage lenders not allowed to ask. Conventional home loans involve a fixed interest rate across payments of 30 20 or 15 years. Web Ask your lender how much income you need to buy a home and which streams of income they consider when they calculate your total earning power.

If you already know what type of mortgage you want it only makes sense to. When youre shopping for a mortgage one of the main things you want. In some cases lenders may build these costs into the interest rate and mortgage points.

What are your down payment requirements. Do you have e-closing options. Since there are many different types of mortgages including.

Ask about PMI Private Mortgage Insurance requirements too. Web So with a 200000 mortgage 1 point would be worth 2000. Web However lenders might ask you to put down more than the minimum especially if some aspect of your finances makes you a riskier borrower.

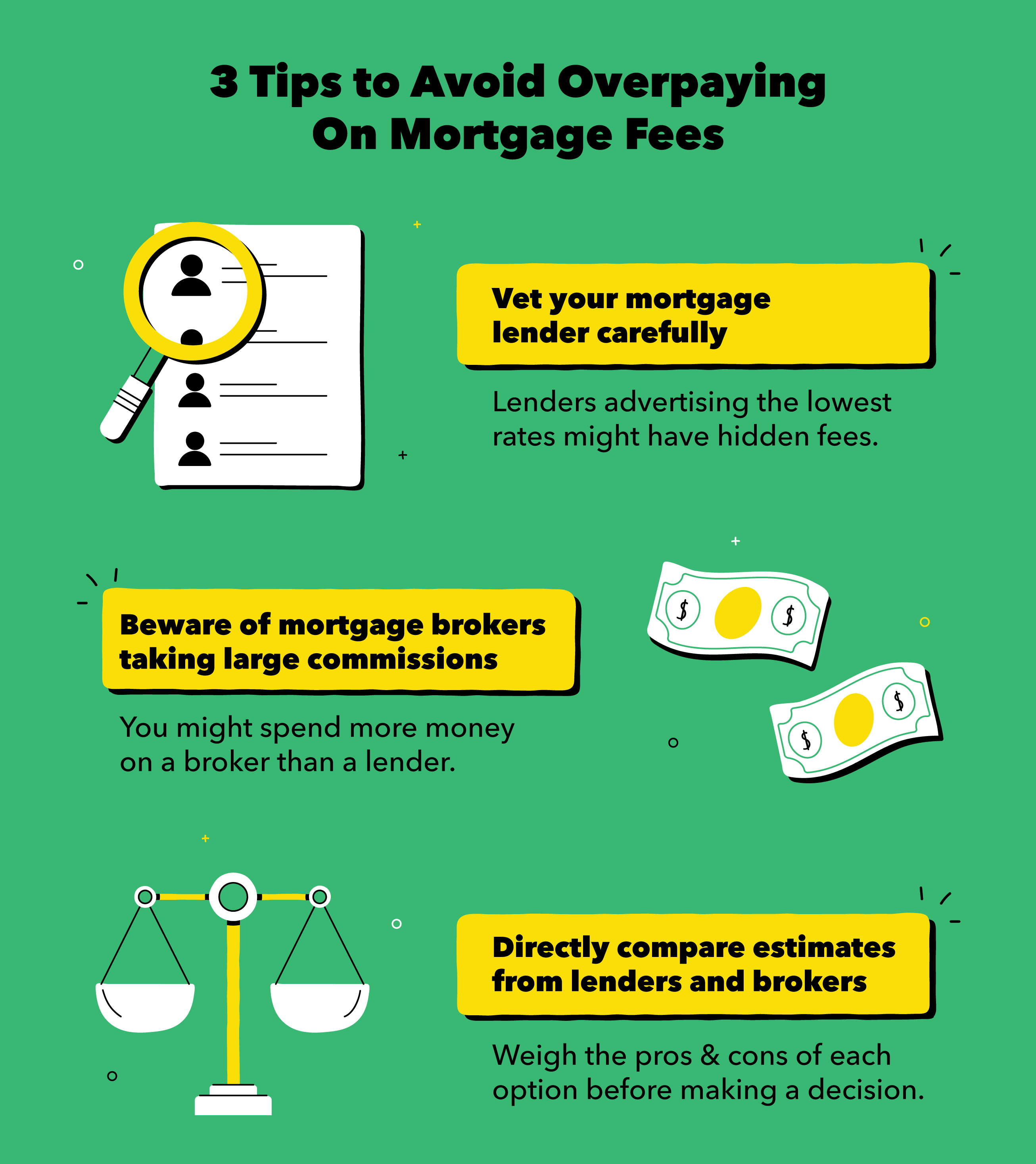

Ask your lender to find out about how much of a down payment you need. Additional Questions for Lenders. Before purchasing a new home or investment property make sure to thoroughly vet your lender.

Be wary if a lender offers a super quick process. Web Talk to a lender about getting prequalified for a mortgage before you start shopping for your new home. Youll also need to bring a cashiers check or proof of wire transfer for the amount due at closing.

Most lenders require a photo ID proof of homeowners insurance and any remaining loan conditions. Which type of loan is right for me. Web Talk to your commercial mortgage lender about financing solutions for your CRE investment.

Web What to look for. Web 8 Questions To Ask Your Mortgage Lender 1. Web Ask your mortgage lender beforehand to itemize every closing cost including expenses like.

To get the best rate and terms for your loan try to put down at least 20 percent of the purchase price. Web About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright. The monthly mortgage payment can be lower than.

On a 300000 mortgage. What Is Your Process for Preapproval. The exact amount of interest that points will take off your mortgage can vary between lenders.

What are the qualifying guidelines for each. Ask for a clear estimate of how long they expect your application to last supported with examples from similar customers in the past. Web It usually takes 30 days or more for a mortgage lender to complete underwriting appraisal and other formalities.

Lender fees Origination fee Service fees Application fee Credit check fee Have your lender walk you through each fee and explain its cost and purpose. Conventional mortgage loans often require a down payment. Thats why its important to ask how much your interest rate will be reduced with each point and if theres a limit to how many points can be purchased.

Web There are a handful of different questions that a mortgage lender will ask about your down payment. Lenders are not permitted to ask any questions that would discourage an applicantFurther government regulations prevent mortgage lenders from denying loans based on race color religion national origin sex marital status age or because you receive public assistance. What Types of Mortgage Loans Do You Offer.

Fixed-Rate Adjustable Rate Federal Housing Administration Veterans Association. If its 20 or greater that will work in your favor although the average first-time homebuyer makes do with a 7 down payment. Web Whether youre planning on buying a home or refinancing here are some questions to ask a mortgage lender to help identify the best partner for you.

Dont forget to inquire about government-backed loans too you may qualify for a 0 down loan. Dont always assume the down payment will be 20 of the cost of the house. Web You should feel free to ask the lender to walk you through each fee so youll know whats getting bundled into your closing costs.

Web With that in mind heres a list of questions to ask your mortgage lender before you sign anything. Web Talk with your lender about the type of mortgage they recommend based on your situation. This fee can be as high as 1 of your total loan amount.

There are a wide range of home loans available and theyre all designed with different people and circumstances in. Web Most lenders will offer a 30-day rate lock at no charge to you but some lenders do charge for rate locks. Web Heres a list of nine questions that you should definitely ask before you commit to a mortgage.

The answer may be just Make a bigger down payment Or you may find there are other loan programs that you might qualify for that dont require. How are you keeping my personal. 2 How much money do I need to put down.

Finally ask your lender what documents you need to give them to prove your income such as W-2s pay stubs bank account information and other materials. Web Fees can vary greatly by lender and they can go up to 3 of the loan amount which can be substantial. Web Your lender will let you know everything you need to bring to closing.

Web By asking about the loans monthly payments you can easily open up a conversation with your lender about making any adjustments like shortening the mortgage length by increasing the monthly payments or vice versa. There are many questions to ask your commercial mortgage lender as you seek financing for a real estate investment. Web Top Questions to Ask Your Mortgage Lender About the Lender.

Web Then ask the lender what your options are. Whom do you represent eg a bank broker finance company. 1 This can make the whole experience go more smoothly.

Mortgage e-closings are becoming an industry standard because of their convenience speed and accuracy. For one the size of the down payment that youre putting toward the purchase is important. Is there someone I can talk to whenever I need to.

Are you licensed by the state. The questions you ask your lender can have a huge impact on your overall experience and may affect your choices when moving. However some lenders like HomeLight Home Loans offer competitive fees so if youre shopping for a mortgage lender ask about their lender fees and factor that into your decision.

What type of loans do you offer. These are fees the borrower can pay the lender in exchange for a reduced interest rate and consequently lower monthly mortgage payments. Web One way to get a lower interest rate is through mortgage or discount points.

Here are some of the fees you can expect to see.

Tips For Improving Credit Credit History Credit Com

Vh Zjri4vdockm

Dpa Loans Josh Bartlett Loan Originator

Nexwest Mortgage Linkedin

Questions To Ask A Mortgage Lender Youtube

Pdf Mortgage Default In Australia Nature Causes And Social And Economic Impacts

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Ask Me About Va Loan Walter Mackelburg Mortgage Loan Officer

25 Best Loan Service Near Temecula California Facebook Last Updated Feb 2023

Questions To Ask A Mortgage Lender

Top 10 Frequently Asked Questions Regarding Mortgages

How To Get A Mortgage From Start To Finish

Full Transparency Mortgage Broker Purchase Refinance Home Loans

Should I Choose A 30 Year Fixed Or Adjustable Rate Mortgage Quora

17 Questions To Ask Your Mortgage Lender Mintlife Blog

25 Best Loan Service Near Jupiter Florida Facebook Last Updated Feb 2023

Questions To Ask A Mortgage Lender